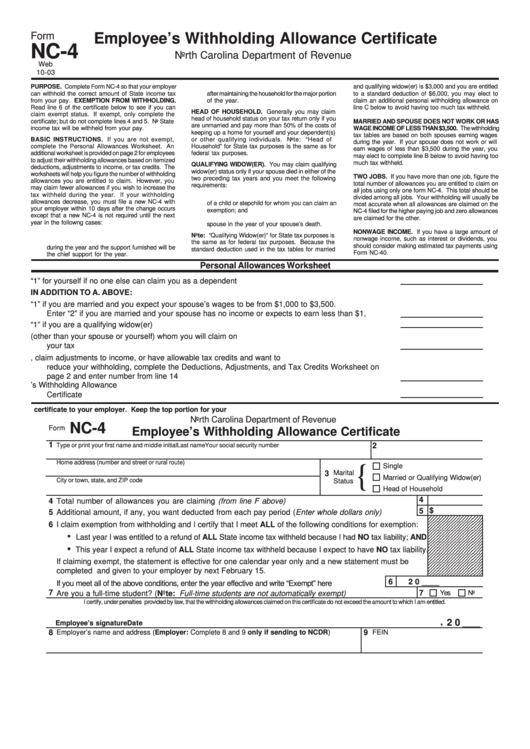

Employee Federal Withholding Form – The Employee Withholding Type (W-4) is made to easily simplify the entire process of finding out your withholding portion. If you are single, have no dependents, and do not itemize deductions, you should utilize the W-4 form. To finish the form, you will need your name, tackle, Societal Protection variety, filing reputation, and trademark. Inside the back links provided listed below, you can get an illustration develop. then follow the directions, ensuring that to signal the document once you can. Employee Federal Withholding Form.

Employee’s Withholding Certification, Form W-4

The Form W-4 – Employee’s Withheld Certification is utilized by the boss to determine simply how much income tax ought to be subtracted from the wage. To avoid owing an excessive amount of taxes, it is vital that you comprehensive the form completely. Your withholding volume can even be changed at any moment. However, you will have to complete a new Form W-4 if you switch employers. It is crucial to review your employer’s policies, before completing a new one.

The IRS website delivers a obtain to the Develop W-4. You can find 5 various actions from the type that must be finished. You need to key in specific data for every step, like your Social Safety variety and processing reputation. When things are filled out, you should indicator the papers to attest that you will be whom you say you happen to be. You will obtain a statement from the IRS once you have correctly filled out the form. Additionally, your employer must obtain a backup of the finished Form W-4 by you.

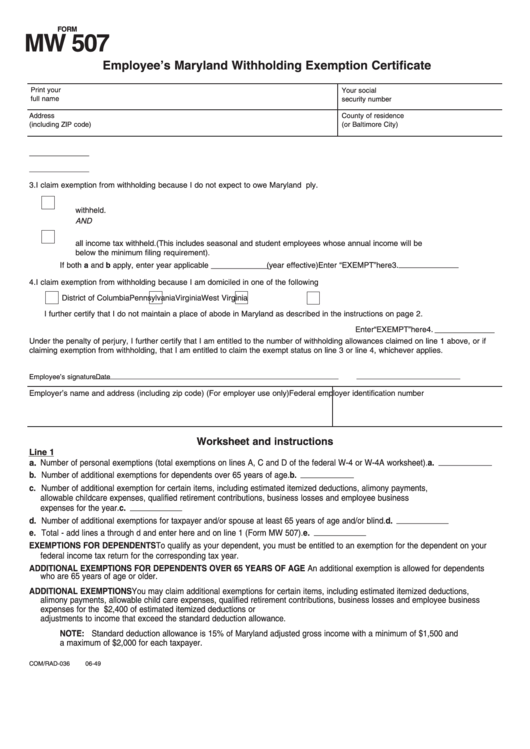

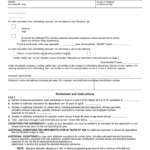

Ask for Exemption from Withholding (IT-2104)

Businesses getting employees younger than 18 are needed to distribute an IT-2104 – Request Exemption From Withholding type annually. Employers utilize it to determine simply how much withholding a staff member is eligible to. If an employee receives allowances totaling more than $14, the employer is required to transmit a copy of the form to the New York State Tax Department. The employer must put in the relevant line if an employee receives no allowances. Series 5 should contain the financial amount that had been additional.

The employer is needed to validate how the personnel has reported all appropriate exemptions following the worker gets a form declaring exemption. When a new personnel is hired, an exact IT-2104 – Ask for Exemption from Withholding type must be accomplished. You can steer clear of a lot of tax season hassles, by doing this. There are various traps in order to avoid. Businesses have to publish individual info on staff members, including birth dates and addresses, around the IT-2104 kind.

Allowances

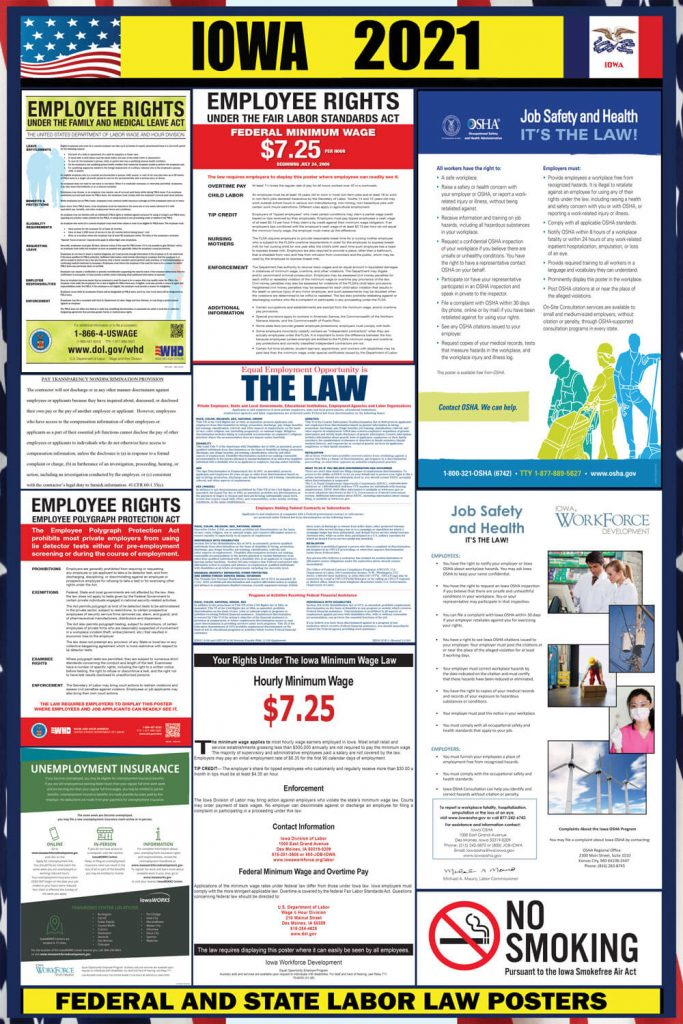

The Allowances for workers Withholding Kind is editable anytime, nevertheless it is recommended that you simply do so whenever your circumstances change. Variations in life events, for example matrimony or breakup, possessing a kid, or proclaiming bankruptcy, ought to be the primary cause of modifying withholding allowances. You ought to update your Kind W-4 properly. You may discover out much better on how to make this happen by looking at Distribution 55. Moreover, several other items can influence withholding allowances.

For instance, if a head of home or single taxpayer works two jobs and earns more than $107,650, he must reduce his allowances by seven. His total earnings must be below this sum if the individual works two jobs. In addition, the allowance must be cut by seven if the recipient has a higher paid employment. If the amount of allowances is negative, the amount of tax due will exceed the entire amount of allowances.

Submit-by times

If your business is required to do so frequently, you should be aware of the deadlines for filing the employee withholding form. The 15th working day of the calendar month following the end in the calendar quarter is definitely the time frame for every quarter declaring. Until you obtain a published alert from your Maryland Comptroller, you have to consistently file this type. You can also provide nonpayroll sums ahead of time and within 3 company days after payroll, as a substitute. Should you be an gardening or in season filer, the time frame to file nonpayroll quantities paid out in Jan is Wednesday, Feb . 17, or Apr 15.

The 15th in the month pursuing the conclusion of the schedule quarter will be the due date for submitting Type L-1. If you pay semi-monthly, you have until the 15th of the month after the end of the calendar quarter to submit your quarterly return. Although you may did not withhold any taxes in that quarter, you must nevertheless data file the form. You should file electronically to avoid charges.

Specifications

Employees have to annually complete a Kind W-4, often known as the worker withholding type. The staff member need to sign the record and offer it on their workplace. There are a few special scenarios that should be included in the kind. It must be mentioned in the develop no matter if a worker carries a loved one, an additional employment, or perhaps a freelancing earnings. Shelling out, residual income, and other sorts of income may also be feasible for someone. Any dependents can be detailed through the staff. The entire amount of income taxes that individual owes might be diminished by these write offs.

Utilizing Kind W-4, a member of staff can check with their boss to prevent withholding federal taxes. The staff member must not happen to be taxed around prior and should not predict being taxed in the current year. A worker who requests a withholding exemption may do so for the duration of a calendar year, but they must reapply by February 15 of the following year. The IRS could require a challenging copy of your form through the worker, dependant upon their distinct scenario.

Cases

You are able to choose the proper total deduct out of your shell out by using an illustration employee withholding form. You can also point out any other earnings or deductions you might have. These could reduce your general taxation obligation. Work with an online estimator or fill out the form yourself to estimate your write offs to ascertain the amount to withhold. You may find out more by using the IRS’s withholding calculator if you’re unclear of how much to withhold.

You fill out the W-4 kind with info about your withholding. The info you offer in the type is commonly used from your boss to ascertain exactly how much payroll taxation you need to spend. Your employer finishes these amounts on your behalf. Wrongly finished forms could result in considerable taxes fines and liabilities. In addition, you will have the choice of experiencing extra taxes deducted from your salary. To prevent problems, you ought to carefully study and know the guidelines about the develop.