2022 Employee Withholding Form – The Worker Withholding Type (W-4) was designed to make simpler the process of identifying your withholding percent. If you are single, have no dependents, and do not itemize deductions, you should utilize the W-4 form. To finish the form, you will require your company name, deal with, Societal Safety quantity, filing status, and unique. In the backlinks presented listed below, you can get one example form. then adhere to the guidelines, ensuring that to indication the file the instant you can. 2022 Employee Withholding Form.

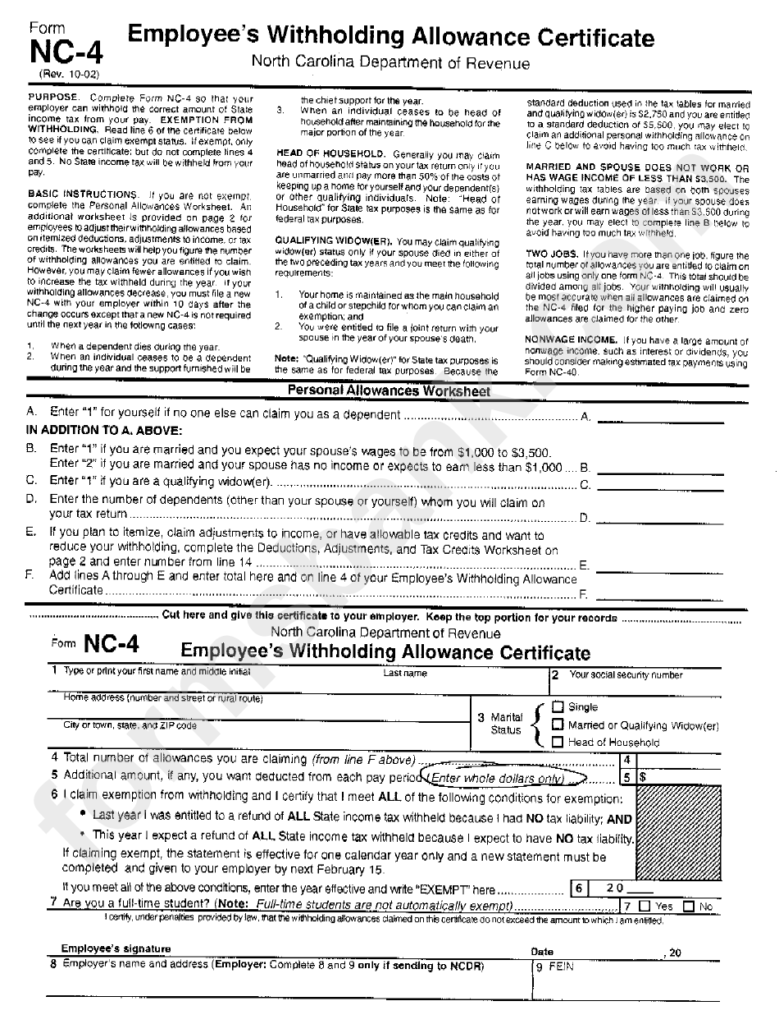

Employee’s Withholding Qualification, Kind W-4

The Shape W-4 – Employee’s Withheld Official document can be used by the employer to determine just how much taxation must be deducted out of your income. In order to avoid owing a lot of taxes, it is vital that you complete the shape completely. Your withholding volume can even be altered whenever you want. However, you will have to complete a new Form W-4 if you switch employers. Before completing a new one, it is crucial to review your employer’s policies.

The Internal Revenue Service site supplies a download for the Form W-4. There are several methods from the form that must definitely be finished. You have to key in certain information for every single stage, such as your Societal Protection variety and filing standing. When things are filled in, you need to signal the document to attest that you are currently the person you say you will be. Once you have correctly filled out the form you will obtain a statement from the IRS. Moreover, your boss should get a version from the finished Develop W-4 by you.

Request for Exemption from Withholding (IT-2104)

Employers possessing staff under the age of 18 are needed to publish an IT-2104 – Request Exemption From Withholding type every year. Businesses make use of it to find out just how much withholding a member of staff is qualified for. If an employee receives allowances totaling more than $14, the employer is required to transmit a copy of the form to the New York State Tax Department. The employer must put in the relevant line if an employee receives no allowances. Range 5 need to include the monetary volume that was extra.

The employer is needed to confirm that the employee has stated all applicable exemptions after the staff gets a type declaring exemption. When a new worker is utilized, an exact IT-2104 – Request Exemption from Withholding type has to be done. You can steer clear of a lot of tax season hassles, by doing this. There are numerous traps to prevent. Businesses must distribute personalized data on staff members, such as arrival days and addresses, about the IT-2104 develop.

Allowances

The Allowances for Employees Withholding Form is editable at any time, nevertheless it is advised that you do so whenever your scenarios alter. Alterations in life occasions, including matrimony or separation and divorce, possessing a kid, or proclaiming individual bankruptcy, needs to be the primary reason behind modifying withholding allowances. You need to enhance your Form W-4 appropriately. You can learn out better concerning how to accomplish this by reading through Publication 55. In addition, a variety of other items may influence withholding allowances.

If a head of home or single taxpayer works two jobs and earns more than $107,650, he must reduce his allowances by seven, for instance. His total earnings must be below this sum if the individual works two jobs. If the recipient has a higher paid employment, in addition, the allowance must be cut by seven. If the amount of allowances is negative, the amount of tax due will exceed the entire amount of allowances.

Data file-by dates

If your business is required to do so frequently, you should be aware of the deadlines for filing the employee withholding form. The fifteenth day from the 30 days once the conclusion in the work schedule quarter will be the deadline for every quarter declaring. Until you will get a published notice in the Maryland Comptroller, you have to persistently document this form. You can even provide nonpayroll sums upfront and inside 3 enterprise time soon after payroll, as a substitute. In case you are an gardening or seasonal filer, the deadline to submit nonpayroll sums paid in January is Wednesday, Feb . 17, or Apr 15.

The fifteenth of your 30 days after the stop of your schedule quarter may be the due day for posting Develop L-1. If you pay semi-monthly, you have until the 15th of the month after the end of the calendar quarter to submit your quarterly return. Even when you did not withhold any income taxes during that quarter, you must continue to submit the form. You should submit digitally to avoid fees and penalties.

Specifications

Staff members need to every year finish a Form W-4, often known as the staff member withholding form. The employee should indicator the file and provide it with their workplace. There are several exclusive situations that should be within the kind. It should be mentioned in the develop regardless of whether a worker includes a partner, another employment, or perhaps a freelancing earnings. Shelling out, passive income, and other income may also be feasible for anyone. Any dependents will also be outlined with the personnel. The overall amount of taxation that person owes may be reduced by these reductions.

Employing Kind W-4, a staff member can check with their employer to prevent withholding federal tax. The worker should never have already been taxed around preceding and should not anticipate being taxed in the present year. They must reapply by February 15 of the following year, although a worker who requests a withholding exemption may do so for the duration of a calendar year. The Internal Revenue Service might require a tough version from the form through the employee, depending on their distinct scenario.

Examples

You may choose the correct amount to deduct from the pay out by making use of a good example worker withholding kind. You could also mention any other revenue or deductions you may have. This can lower your total taxation burden. Use an on the web estimator or complete the shape you to ultimately estimate your write offs to discover the figure to withhold. If you’re unclear of how much to withhold, you may find out more by using the IRS’s withholding calculator.

You fill in the W-4 type with info about your withholding. The info you supply around the form is commonly used by your employer to determine just how much payroll taxation you need to pay out. Your company completes these amounts on your behalf. Inaccurately done kinds could result in significant tax liabilities and fines. Moreover, you will find the use of possessing additional income taxes deducted out of your earnings. To avoid errors, you need to cautiously go through and comprehend the instructions in the kind.