Alabama State Withholding Form 2022 – Before filing your annual state withholding tax form, you should be aware of a few things. The W-4, also called the IL-W-4, is really a form that you need to very first discover ways to submit. If you are a self-employed person, you can also use this form. You can do this for free online, typically. The form is offered for download in the Internal revenue service web site. The shape are able to be prepared easily following the directions onto it. Alabama State Withholding Form 2022.

Form W-4

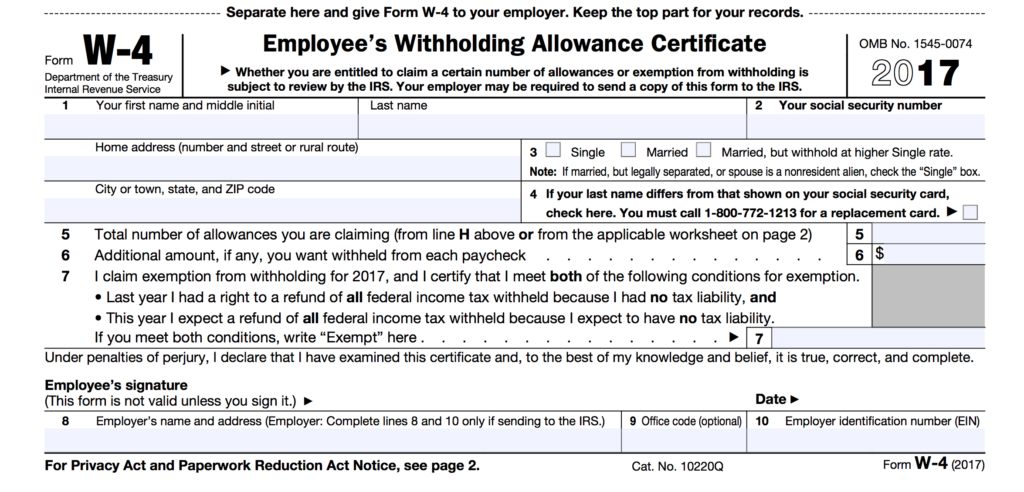

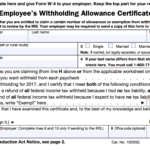

Each and every year, all workers must file their state Withholding Taxation Develop with the IRS. Workers may possibly established apart further cash for taxes reasons while using kind. The repayment to become withheld is given from the mixed revenue of your and you loved one. No matter if you’re hitched or not, it’s important to give honest information on your Develop W-4. The Internal Revenue Service offers a variety of worksheets to help you see how much taxation you happen to be eligible for. As an alternative, you may determine how much money you can write off annually using the NerdWallet tax calculator.

You should correctly total their state Withholding Qualification to stop overpaying taxes. Organisations can use this form to establish just how much tax needs to be deducted from employees’ paychecks. A huge stability at tax time, or worse, being fined for over-withholding, could are caused by wrongly completing the form. The brand new W-4 Kind swithces worksheets with much easier inquiries although nevertheless utilizing the same info as being the aged one particular. Staff must now have the capacity to compute their withholdings much more specifically thanks to this change.

If you do not have any dependents, you can complete the W-4 form without providing your SSN. If your circumstances or your job change, you must update your information each year. If you change employment during the year in order to pay less tax, you might ask for a part-year approach of withholding. Even though it’s important to comprehensive the form accurately, there can be circumstances when you really need to change your withholding over the course of the entire year. If you start a new employment in the middle of the year, ask for a part-year withholding mechanism.

You should mail the form to the state tax office once it has been completed. The W A HarrimanAlbany and Campus, New York 12227-0865 is where you may find the NYS Tax Division. For more information, see to Publication 55 if you are unable to transmit the form via US mail. If you don’t get it within a year, you should mail it by certified correspondence.

Variety IL-W-4

An essential file is the Status Withholding Allowance Certificate. It instructs your company exactly how much status tax ought to be deducted from your income of your workers. The form is easy to perform which is required legally. If you’re unsure of how to complete yours, Consult Publication 55. Each a example worksheet and instructions are offered. It will ultimately save you a bunch of time and hassle.

If you’re married and your combined income is $107,650 or higher, use the Part 5 withholding table. Use this visual by replacing the lower-paying out job’s earnings with all the increased earner’s wages. You shouldn’t worry about the taxation as this action will lessen your income tax culpability. The $ level of the increased withholding should be calculated a second time. Compute your sum then send the shape.

If you’re an employer, you must submit a different form for employees. A lawfully needed papers is the Kind W-4. The shape can be completed and agreed upon by staff members. To complete the form, it is actually recommended to utilize the shape IL-W-4. You might submit the form through the help of a totally free guide. Also keep in mind that you can adjust the form’s withholding volume at any time during the year.

Some areas additional demand that employees complete condition withholding types along with the federal government W-4. In order for your employer to deduct the right amount of tax from your paycheck if you reside in one of these states, you must fill out and submit the state withholding form. The W-4 is a useful tool, but it needs to be filled out correctly. If you switch jobs, a new W-4 must be completed.

You must submit the Form W-4 if you reside in Illinois. If you don’t have any dependents, you should still claim the appropriate number of allowances on your state’s form even. The calculator may be used to help in deciding just how much must be withheld. Your once-a-year tax obligation can be determined making use of the IRS website’s calculator. You may once more apply it to determine out how much cash you can set up for retirement living.