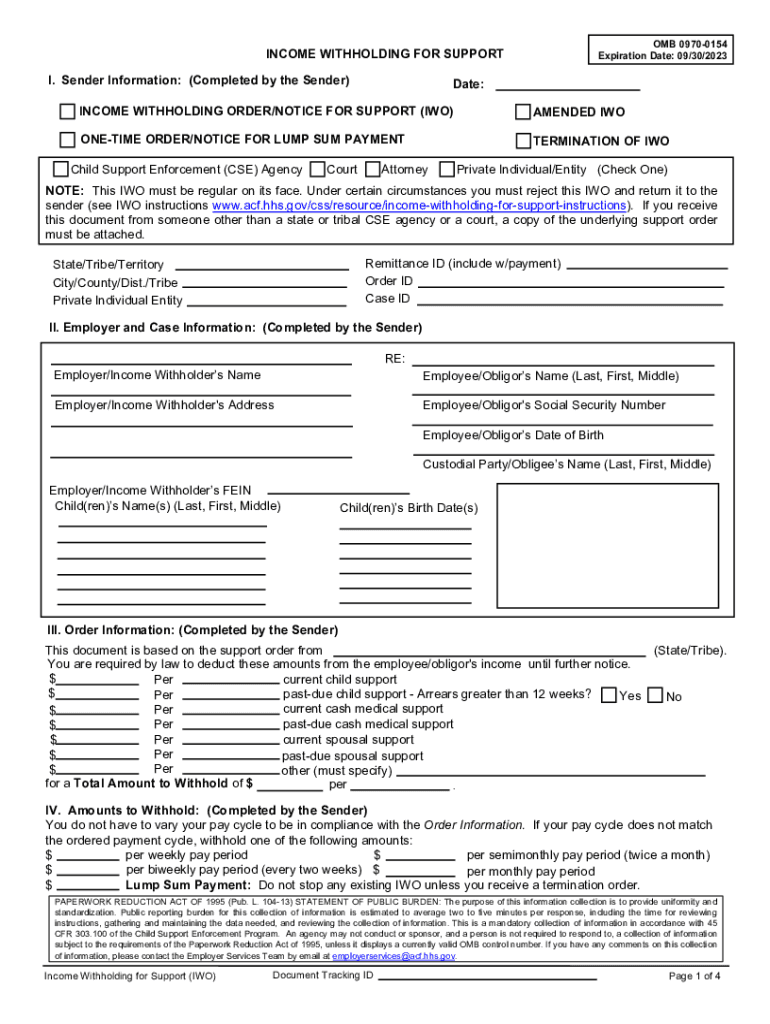

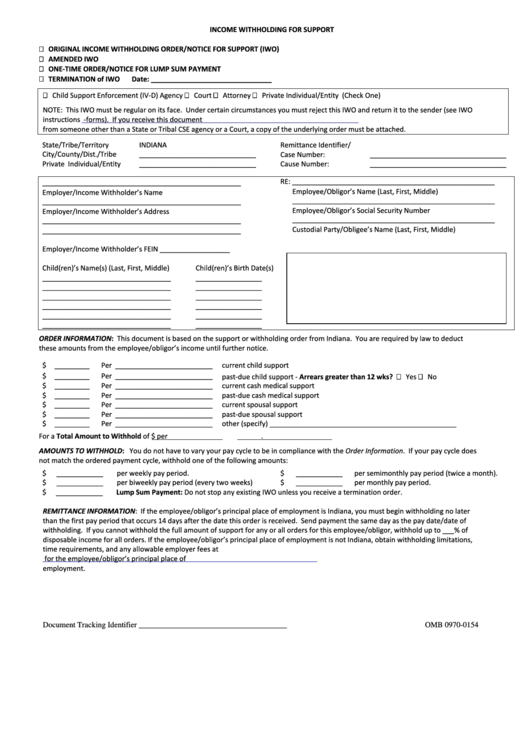

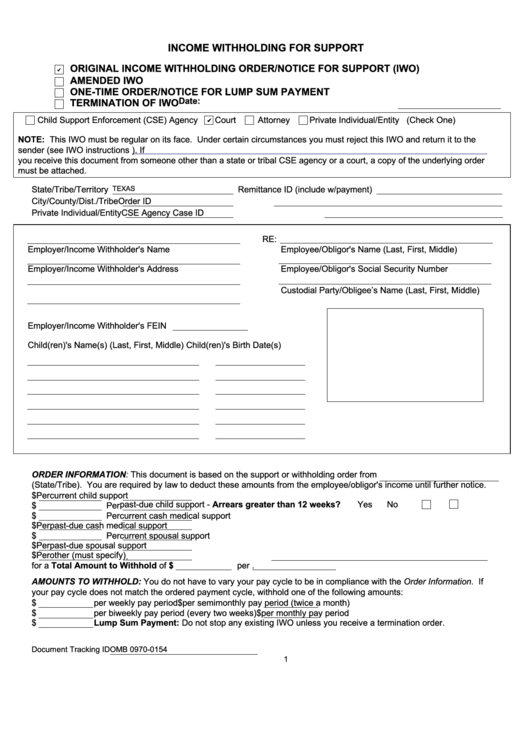

Federal Income Withholding For Support Form – Organisations make use of Earnings Withholding Purchases, or IWOs, that are federal government kinds, to take taxation repayments from workers’ paychecks. IWOs may be physically or mechanically filled out, and so they normally adhere to a form given by the IRS. If you are aware of how IWOs operate, the procedure is quite straightforward. Below are a few hints and pointers that will help you accomplish your revenue withholding kind. Federal Income Withholding For Support Form.

Orders placed for Income Withholding

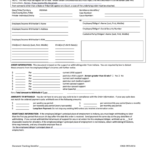

A purchase known as the “Income Withholding Order” directs the employer to withhold a specific sum of money from each and every employee’s income. The Customer Security Respond mandates the use of money Withholding Get. Generally speaking, the deduction should not be more than 50Percent of the Obligor’s throw-away income. If they choose not to withhold money from an employee, the employer could face sanctions.

An Ex Parte Revenue Withholding Get instructs a payor to take a certain amount from an obligor’s regular monthly income. Typically, these orders are issued without providing the obligor with any prior notice of the order. Employers are compelled to begin subtracting obligations as soon as they are received and to send the cash straight back to the obligor in seven company events of the spend day. A Division of Child Support Enforcement or Condition Intravenous-D organization problems money withholding order (DCE). If it is typically not required to be signed, the employer must receive it even.

IWOs

You unquestionably gotten Cash flow Withholding Types should you get paychecks through your firm (IWOs). Whenever you get them, you might not realize how to make use of them or what to look for. The correct answer is within the Supporting Your Children Division from the Business office of Lawyer or attorney General (OAG). You can fill out a software on the web in the OAG Supporting Your Children Division’s web site. You should make sure to send the IWO to your new employer if you have one.

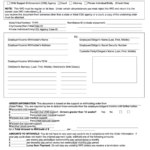

Make sure to include the amount in your withholding if an employee has over-the-limit withholding. The total amount to be withheld should at the minimum match up this amount. Be sure to update the total amount for your pay cycle, as you might need to alter the Maximum Withholding %. To calculate exactly how much you are going to owe, make use of the Withholding Limits Worksheet, which capabilities an internet calculator.

electronic digital formats

Your business could possibly save time by utilizing auto income withholding forms. For first time staff members, classic varieties might be perplexing. The process is sped up using a wizard-like user interface on automatic types. They perform calculations quickly and impose good sense laws and regulations. As a result, there is no longer a chance of conflicting withholding decisions being made, and new recruits are less likely to make mistakes or forget to electronically sign their paperwork. HR can also save time and effort by utilizing computerized forms.

Organizations with a lot of locations will benefit considerably by using a computerized system. Every place features its own distinctive tax varieties, even though some says tend not to impose an income taxation. By using a centralized online system, you can make sure the right forms are supplied in accordance with local laws. No longer are several personnel need to be contacted in order to make changes. Company can then give full attention to more vital duties this way. By removing the need to find forms, it also saves time and money.

Restrictions

Employers must declare the total amount they are deducting from employees’ paychecks on the restrictions on income withholding form and make up the difference within seven days, according to the law. Employers may be held liable for the whole amount of the withheld amounts if they don’t follow the rules. A $100 good is additionally enforced about the workplace on a daily basis that the withheld sums will not be paid out. Companies can, nevertheless, stay away from this obligation by adhering to the CCPA regulations.

Companies have to adhere to the earnings withholding limitations establish by the federal government. The Buyer Credit history Protection Act, which controls repayments to CSPC, establishes the federal limitations. The government has posted a message of viewpoint on lump-amount of money mandates and payments that companies abide by the guidelines. However, many firms disregard these rules and wind up shelling out more money than necessary. Businesses are required to adhere to the revenue withholding constraints for this reason.

labeling the low-custodial father or mother

The business is going to be informed that this noncustodial parent’s child support requirement arrives and must be paid for from the confirming noncustodial mother or father in the earnings withhold develop. Additionally, it is going to notify the noncustodial parent that their certificate has been stopped. To get their certification reinstated, a noncustodial father or mother should adhere to the supporting your children payback program specific about this form.

Employers could not reply to questions from staff concerning earnings withholding. The Non-Custodial Mother or father Notice, which can be contained in the employer’s withholding packet, needs to be pointed out to workers alternatively. The guidelines for tough the revenue withholding purchase will also be outlined on this kind. The employer should direct them to the notice if an worker has any inquiries or concerns. It is important to get this particular type available because it is available too at the State pay out unit.