Hawaii Employee Withholding Form – The Staff Member Withholding Form (W-4) was designed to streamline the whole process of figuring out your withholding percent. You should utilize the W-4 form if you are single, have no dependents, and do not itemize deductions. To end the shape, you will require your company name, address, Interpersonal Protection number, submitting reputation, and unique. In the links offered beneath, you can get one example type. then follow the guidelines, ensuring that to indication the document as soon as you can. Hawaii Employee Withholding Form.

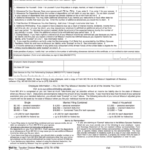

Employee’s Withholding Certification, Form W-4

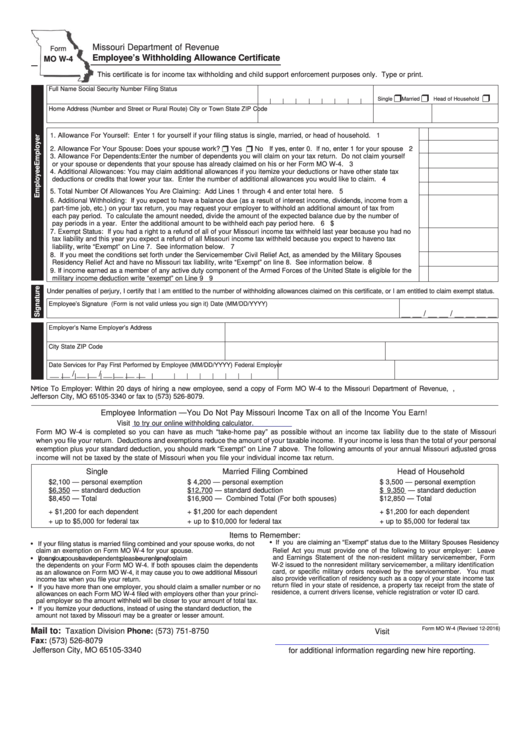

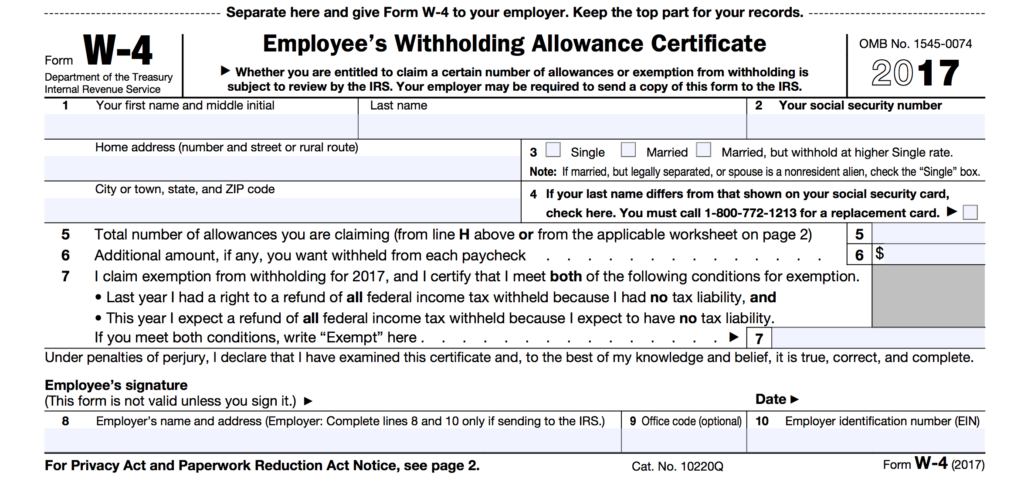

The Shape W-4 – Employee’s Withheld Qualification can be used through your boss to determine simply how much tax ought to be subtracted out of your wage. To protect yourself from owing too much taxes, it is essential that you total the shape totally. Your withholding amount may also be transformed whenever you want. However, you will have to complete a new Form W-4 if you switch employers. It is crucial to review your employer’s policies, before completing a new one.

The IRS internet site provides a acquire to the Develop W-4. There are five actions in the develop that must definitely be concluded. You must enter a number of info for each step, for example your Sociable Safety quantity and submitting reputation. When everything is completed, you must sign the record to attest that you will be that you say you are. Once you have correctly filled out the form you will obtain a statement from the IRS. Moreover, your company need to obtain a version of the accomplished Type W-4 of your stuff.

Ask for Exemption from Withholding (IT-2104)

Companies having personnel under the age of 18 are needed to submit an IT-2104 – Request Exemption From Withholding kind each year. Businesses use it to figure out just how much withholding a member of staff is eligible to. The employer is required to transmit a copy of the form to the New York State Tax Department if an employee receives allowances totaling more than $14. The employer must put in the relevant line if an employee receives no allowances. Line 5 must have the financial sum which had been included.

The employer must affirm that this employee has claimed all suitable exemptions once the staff receives a kind declaring exemption. When a new staff is employed, a precise IT-2104 – Request for Exemption from Withholding type should be accomplished. You can steer clear of a lot of tax season hassles, by doing this. There are numerous traps to protect yourself from. Companies must publish private data on staff members, for example birth dates and handles, on the IT-2104 develop.

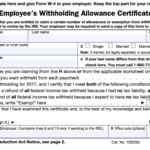

Allowances

The Allowances for Employees Withholding Form is editable anytime, nevertheless it is suggested that you simply do so whenever your circumstances modify. Alterations in lifestyle events, like matrimony or separation and divorce, developing a child, or declaring personal bankruptcy, ought to be the principal cause of adjusting withholding allowances. You need to enhance your Form W-4 accordingly. You can uncover out far better about how to do this by reading through Distribution 55. In addition, several other things may influence withholding allowances.

If a head of home or single taxpayer works two jobs and earns more than $107,650, he must reduce his allowances by seven, for instance. His total earnings must be below this sum if the individual works two jobs. In addition, the allowance must be cut by seven if the recipient has a higher paid employment. The amount of tax due will exceed the entire amount of allowances if the amount of allowances is negative.

Document-by dates

You should be aware of the deadlines for filing the employee withholding form if your business is required to do so frequently. The 15th day from the calendar month right after the end of your calendar quarter may be the due date for every quarter declaring. Up until you get a created notification through the Maryland Comptroller, you have to consistently document this particular type. Also you can provide nonpayroll sums upfront and in a few enterprise days soon after payroll, as an alternative. In case you are an agricultural or in season filer, the due date to submit nonpayroll quantities paid out in Jan is Wednesday, Feb . 17, or Apr 15.

The fifteenth of your month after the conclusion from the calendar quarter will be the due time for posting Develop L-1. You have until the 15th of the month after the end of the calendar quarter to submit your quarterly return if you pay semi-monthly. Even though you failed to withhold any income taxes during that quarter, you need to still document the form. You have to submit digitally to avoid penalty charges.

Needs

Employees must every year complete a Develop W-4, also known as the worker withholding develop. The employee must indication the papers and provide it on their workplace. There are many unique circumstances that should be included in the form. It must be documented on the kind regardless of whether a worker has a husband or wife, a 2nd work, or even a freelancing income. Committing, residual income, and other types of cash flow may also be possible for anyone. Any dependents can also be outlined by the personnel. The overall level of taxation that individual owes may be diminished by these reductions.

Utilizing Form W-4, a worker can question their company to stop withholding federal government taxes. The staff member must not happen to be taxed in before and should not expect simply being taxed in the current year. A worker who requests a withholding exemption may do so for the duration of a calendar year, but they must reapply by February 15 of the following year. The Internal Revenue Service may demand a hard version in the develop in the staff, dependant upon their particular situation.

Good examples

You are able to choose the appropriate add up to subtract through your pay by using an illustration staff withholding develop. You can also point out almost every other revenue or deductions you could have. These could reduce your overall tax responsibility. Make use of an online estimator or fill in the form you to ultimately estimation your write offs to look for the amount to withhold. You may find out more by using the IRS’s withholding calculator if you’re unclear of how much to withhold.

You fill in the W-4 kind with information regarding your withholding. The info you supply on the type can be used from your boss to figure out exactly how much payroll taxation you have to shell out. Your company completes these amounts for you. Inaccurately finished types could cause significant income tax liabilities and fines. Furthermore, you will have the option of getting additional income taxes subtracted from your salary. To stop faults, you need to carefully go through and comprehend the directions around the develop.