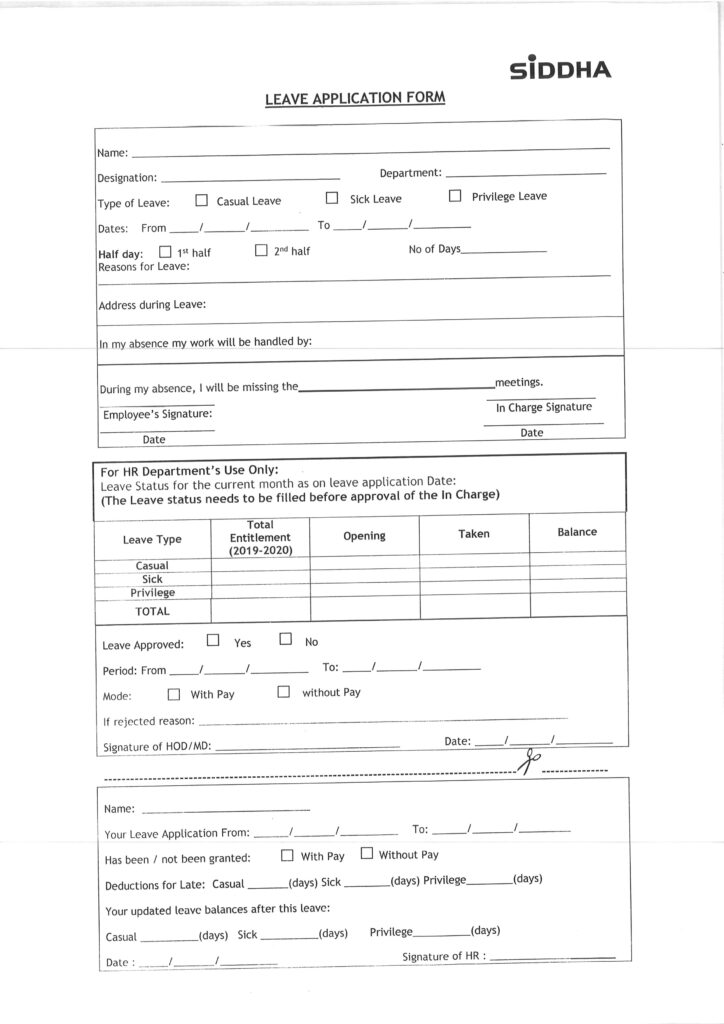

Michigan Withholding Employee Form – The Worker Withholding Kind (W-4) was designed to streamline the procedure of determining your withholding percent. You should utilize the W-4 form if you are single, have no dependents, and do not itemize deductions. In order to complete the form, you will require your own name, address, Social Stability quantity, submitting position, and personal. From the links presented below, you will discover a good example type. then follow the directions, making certain to indication the record as soon as you can. Michigan Withholding Employee Form.

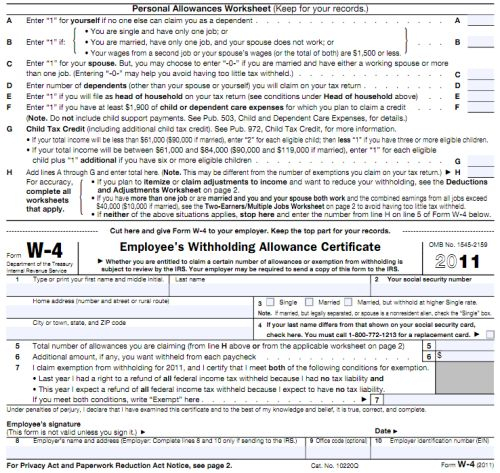

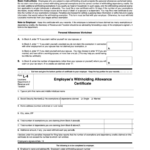

Employee’s Withholding Official document, Kind W-4

The Form W-4 – Employee’s Withheld Certification is commonly used by the boss to determine how much income tax should be deducted from the earnings. To avoid owing too much income tax, it is vital that you complete the shape fully. Your withholding quantity can even be changed whenever you want. However, you will have to complete a new Form W-4 if you switch employers. Before completing a new one, it is crucial to review your employer’s policies.

The IRS web site delivers a obtain for your Type W-4. There are five methods in the kind that must definitely be done. You should key in specific details for each and every phase, for example your Social Protection variety and submitting standing. When things are filled out, you must indication the papers to attest you are the person you say you are. You will obtain a statement from the IRS once you have correctly filled out the form. Moreover, your boss must get a backup of the finished Form W-4 on your part.

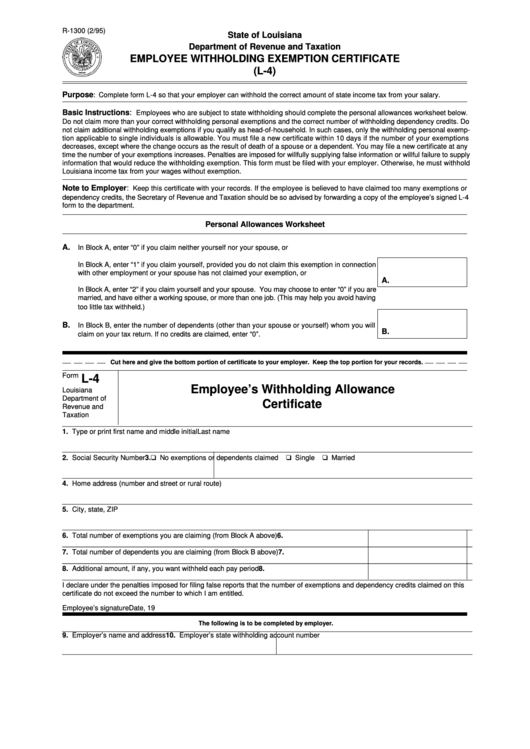

Ask for Exemption from Withholding (IT-2104)

Employers having staff younger than 18 are needed to distribute an IT-2104 – Request Exemption From Withholding kind each and every year. Organisations make use of it to find out exactly how much withholding a worker is eligible for. If an employee receives allowances totaling more than $14, the employer is required to transmit a copy of the form to the New York State Tax Department. If an employee receives no allowances, the employer must put in the relevant line. Series 5 ought to contain the monetary sum that was added.

The business is necessary to affirm how the employee has stated all relevant exemptions after the personnel gets a type declaring exemption. Each time a new personnel is used, an accurate IT-2104 – Request Exemption from Withholding develop needs to be completed. By doing this, you can steer clear of a lot of tax season hassles. There are several traps in order to avoid. Companies are needed to submit personal details on workers, for example delivery schedules and handles, around the IT-2104 form.

Allowances

The Allowances for workers Withholding Form is editable at any time, nonetheless it is suggested that you simply do so whenever your scenarios change. Modifications in lifestyle situations, such as marriage or separation and divorce, using a youngster, or declaring personal bankruptcy, ought to be the primary reason for adjusting withholding allowances. You should improve your Kind W-4 consequently. It is possible to uncover out greater on how to make this happen by reading Publication 55. In addition, numerous other stuff can influence withholding allowances.

If a head of home or single taxpayer works two jobs and earns more than $107,650, he must reduce his allowances by seven, for instance. His total earnings must be below this sum if the individual works two jobs. In addition, the allowance must be cut by seven if the recipient has a higher paid employment. The amount of tax due will exceed the entire amount of allowances if the amount of allowances is negative.

Document-by dates

If your business is required to do so frequently, you should be aware of the deadlines for filing the employee withholding form. The 15th working day of the four weeks after the end from the work schedule quarter will be the time frame for quarterly filing. Up until you obtain a written notice through the Maryland Comptroller, you should consistently document this kind. You may also supply nonpayroll sums beforehand and inside of 3 business times after payroll, as a replacement. When you are an gardening or holiday filer, the time frame to submit nonpayroll sums compensated in Jan is Wednesday, February 17, or Apr 15.

The 15th in the calendar month pursuing the stop from the work schedule quarter will be the because of particular date for submitting Develop L-1. You have until the 15th of the month after the end of the calendar quarter to submit your quarterly return if you pay semi-monthly. Although you may did not withhold any taxes in that quarter, you have to nevertheless document the form. You should document digitally to prevent penalties.

Demands

Staff members have to every year finish a Form W-4, also called the employee withholding type. The staff member should indicator the papers and offer it to their company. There are many unique circumstances that must be within the kind. It should be noted about the develop whether a worker has a loved one, a 2nd work, or a freelancing income. Making an investment, passive income, and other kinds of income are also probable for a person. Any dependents may also be detailed with the employee. The complete amount of taxes that individual owes may be decreased by these write offs.

Making use of Kind W-4, an employee can check with their boss to prevent withholding federal income tax. The employee should never have already been taxed in the year before and should not predict being taxed in the current year. They must reapply by February 15 of the following year, although a worker who requests a withholding exemption may do so for the duration of a calendar year. The Internal Revenue Service may demand a tough backup of your type from your personnel, based on their distinct situation.

Cases

You may choose the appropriate amount to subtract from the spend by using an illustration worker withholding type. You might also refer to any other revenue or deductions you could have. These could lower your total taxes requirement. Make use of an online estimator or fill out the form you to ultimately estimation your write offs to look for the figure to withhold. If you’re unclear of how much to withhold, you may find out more by using the IRS’s withholding calculator.

You fill in the W-4 type with info about your withholding. The info you supply about the form is commonly used by your employer to determine just how much payroll income tax you need to pay out. Your workplace concludes these sums on your behalf. Wrongly done types could cause substantial taxes fines and liabilities. Additionally, you have the use of experiencing further income taxes subtracted through your earnings. To prevent problems, you must cautiously read through and comprehend the recommendations in the type.