Nc State Form Withholding – You should be aware of a few things before filing your annual state withholding tax form. The W-4, also known as the IL-W-4, is really a develop you need to initially figure out how to fill out. You can also use this form if you are a self-employed person. Typically, you can do this for free online. The shape is accessible for acquire in the Internal revenue service website. The shape are able to prepare yourself rapidly by simply following the guidelines into it. Nc State Form Withholding.

Develop W-4

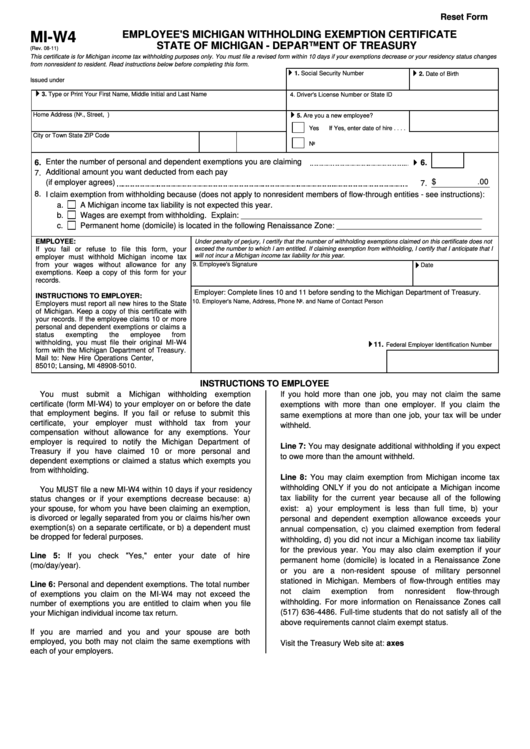

Each and every year, all staff members are needed to submit their state Withholding Taxation Type with the IRS. Staff members may set out additional cash for taxes functions while using type. The payment being withheld is given by the combined cash flow of you and your loved one. Whether or not you’re wedded or perhaps not, it’s essential to provide honest facts about your Form W-4. The IRS gives numerous worksheets to assist you to work out how significantly tax you might be entitled to. You may determine how much money you can write off annually using the NerdWallet tax calculator, as an alternative.

You need to precisely complete their state Withholding Certification to stop overpaying taxation. Businesses can use this type to indicate simply how much taxation must be subtracted from employees’ paychecks. A tremendous equilibrium at tax time, or even worse, becoming fined more than-withholding, could are caused by inaccurately filling in the form. The brand new W-4 Type replaces worksheets with simpler questions when still using the same details as the older one particular. Workers ought to now be capable of estimate their withholdings much more specifically due to this modification.

If you do not have any dependents, you can complete the W-4 form without providing your SSN. You must update your information each year if your circumstances or your job change. If you change employment during the year in order to pay less tax, you might ask for a part-year approach of withholding. Though it’s essential to complete the shape accurately, there could be circumstances when you need to change your withholding during the course of the season. Ask for a part-year withholding mechanism if you start a new employment in the middle of the year.

You should mail the form to the state tax office once it has been completed. The W A HarrimanAlbany and Campus, Ny 12227-0865 is where you may find the NYS Income tax Section. For more information, see to Publication 55 if you are unable to transmit the form via US mail. You should mail it by certified correspondence if you don’t get it within a year.

Variety IL-W-4

An important document is the Condition Withholding Allowance Official document. It instructs your company how much condition income tax needs to be deducted from your earnings of the staff. The form is simple to perform and is required by law. If you’re unsure of how to complete yours, Consult Publication 55. The two a test instructions and worksheet are given. It can in the end save you a lot of hassle and time.

Use the Part 5 withholding table if you’re married and your combined income is $107,650 or higher. Make use of this graphic by replacing the low-paying job’s earnings with the greater earner’s income. You shouldn’t be worried about the income tax as this motion will decrease your tax accountability. The $ quantity of the increased withholding also need to be computed a second time. Determine your volume after which send the shape.

You must submit a different form for employees if you’re an employer. A officially essential record is the Form W-4. The form might be filled out and approved by workers. To accomplish the shape, it is advised to utilize the shape IL-W-4. You may submit the form using a no cost manual. Also take into account that you are able to modify the form’s withholding sum whenever you want in the past year.

Some areas more need that staff total status withholding varieties as well as the federal government W-4. In order for your employer to deduct the right amount of tax from your paycheck if you reside in one of these states, you must fill out and submit the state withholding form. It needs to be filled out correctly, although the W-4 is a useful tool. If you switch jobs, a new W-4 must be completed.

If you reside in Illinois, you must submit the Form W-4. You should still claim the appropriate number of allowances on your state’s form even if you don’t have any dependents. The calculator may be used to help in figuring out exactly how much must be withheld. Your twelve-monthly taxation obligation could be determined while using IRS website’s calculator. You are able to yet again apply it to compute out the amount of money you can setup for retirement life.