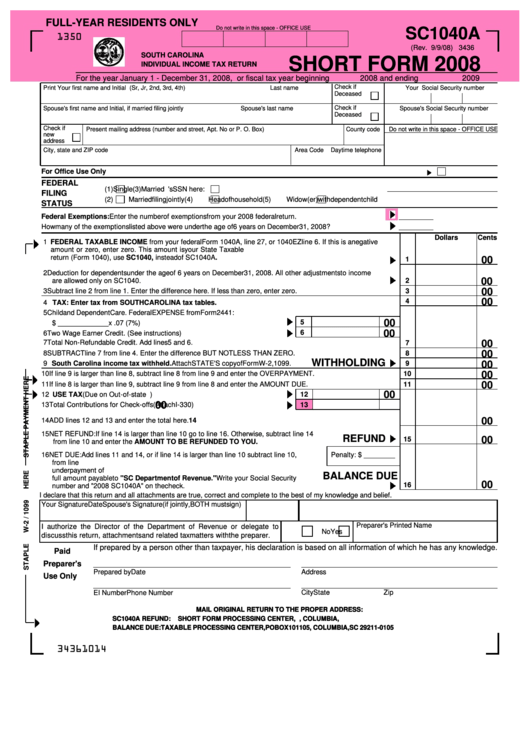

South Carolina Income Tax Withholding Form – You should very first know about the W-4 and also the information it takes before you understand why you need to finish a tax withholding type. Your boss will use the data you supply around the W-4 develop to find out exactly how much taxes ought to be subtracted from the salary. This form is crucial for ensuring that the IRS appropriately gathers national tax. When withholding an excessive amount of could result in a reimbursement if you submit your tax return, withholding the improper sum could cause fees and penalties along with a tax expenses. South Carolina Income Tax Withholding Form.

Kind W-4

You should review it each pay period to be sure the amount is accurate if your firm withholds taxes from your employees using Form W-4. You might have to pay more in federal taxes when you file your return if it’s wrong. After having a main life occasion, such as a new task or relationship, you must reassess your withholding percent. Your withholding sum will even differ according to the scale of your family members, the amount of revenue you are making annually, and any tax credits.

The a number of career withholding cycle ought to be done for hitched couples and individuals who work several work. It would calculate the right income tax withholding amount to withhold from each of your incomes. You could be entitled to the kid income tax credit rating or any other dependant taxation credit score, for the way many tasks you might have. Use the W-4 estimator supplied by the internal revenue service or a web site like NerdWallet’s income tax calculator to obtain an exact estimate.

the features for filling out a W-4

It is important to adhere to the IRS’s instructions whilst filling in a W-4 taxation withholding develop. In accordance with the kind of income you obtain, there are alternative methods to fill out this kind properly. You must fill out Sections A and B of the form, for instance, if you work two jobs and are paid a combined wage. Or else, you should accomplish Methods 1 and 2.

You should file your W-4 as soon as your employment standing changes or another problem modifications to ensure that you gratify each of the conditions. It’s also crucial to keep in mind that the IRS expects people to pay their taxes all year long, so if insufficient money was withheld, you can end up owing a lot of money come April. Penalties and interest might end result for that reason.

Exemptions from taxation withholding available

You can seek for a tax exemption if you work for a government organization. The us government organization will then speak to you and provide the relevant information and facts, including just how much tax will likely be subtracted through your income. Joblessness insurance policy, societal stability, Medicare, and supporting your children are typical exempt from taxation withholding. Each and every year, you have to distribute fresh forms towards the company. You could potentially even enter interaction with your workplace. Your situations could let you use a couple of exception.

You can petition for a federal income tax exemption if your state doesn’t take any taxes from your paycheck. The government will issue you a refund check if you qualify for one of the exclusions. You can request an exemption from tax withholding if your income is below the IRS’s limits. If your income exceeds the qualifying levels, you want to think about filing an exemption, however.

Calculator for withholding estimations

The income tax return’s complex estimations can be a obstacle for many people. You possibly can make sensation of your stats and compute the perfect withholding percentage for your personal situations with the aid of a taxes withholding calculator. The discoveries of the calculator may not specifically match up precisely what is on the salary, whilst they may well supply you with a decent idea of your income tax obligations. In this case, it’s crucial to double-check the calculator inputted statistics. If they are different, you should get in touch with your employer and ask for a recalculation.

You should use sometimes the proportion or even the exact level of taxation you owe to determine the appropriate amount of withholding. Whether or not you make use of an automated or manual payroll process, it is advisable to use a calculator to determine taxation withholding. The calculator will guide you with the process and get taxation credits into mind to compute the precise volume you must withhold. If you don’t follow the guidelines, you can owe more money at the end of the year than you anticipated. Within the second option case, you could be necessary to pay more fees and attention.

Problems for no-United states citizens

The form must be served out and marked by the employee in order to declare taxable income for a non-citizen. The two employee’s Societal Safety variety and an lively ITIN are essential. Just for declaring government taxes, it is recommended to begin using these numbers to confirm an employee’s detection. Some no-U.S. people may need to give much more data to verify their standing, depending on the sort of job.

Somebody Tax payer Recognition Variety is required for non-people in order to be eligible for a Sociable Stability quantity (TIN). This nine-digit amount is similar to a societal safety quantity. The TIN’s initially about three numbers must be involving 88 and 70; the 4th digit must be among 92 and 90. 94-99 ought to be the fourth and fifth digits.