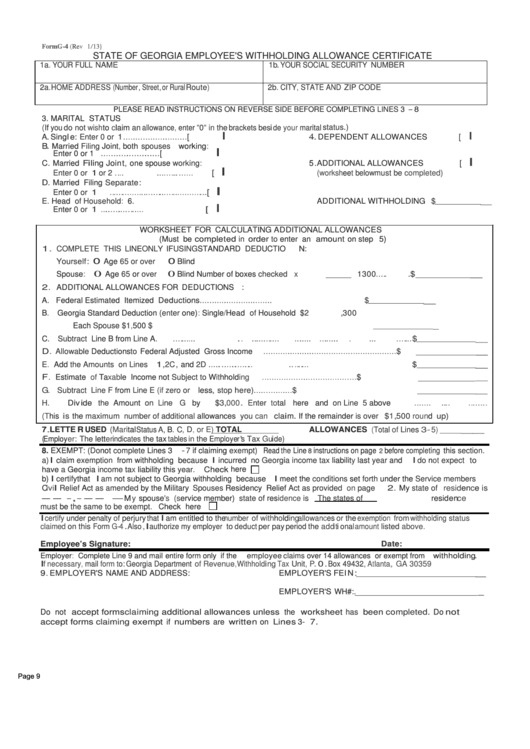

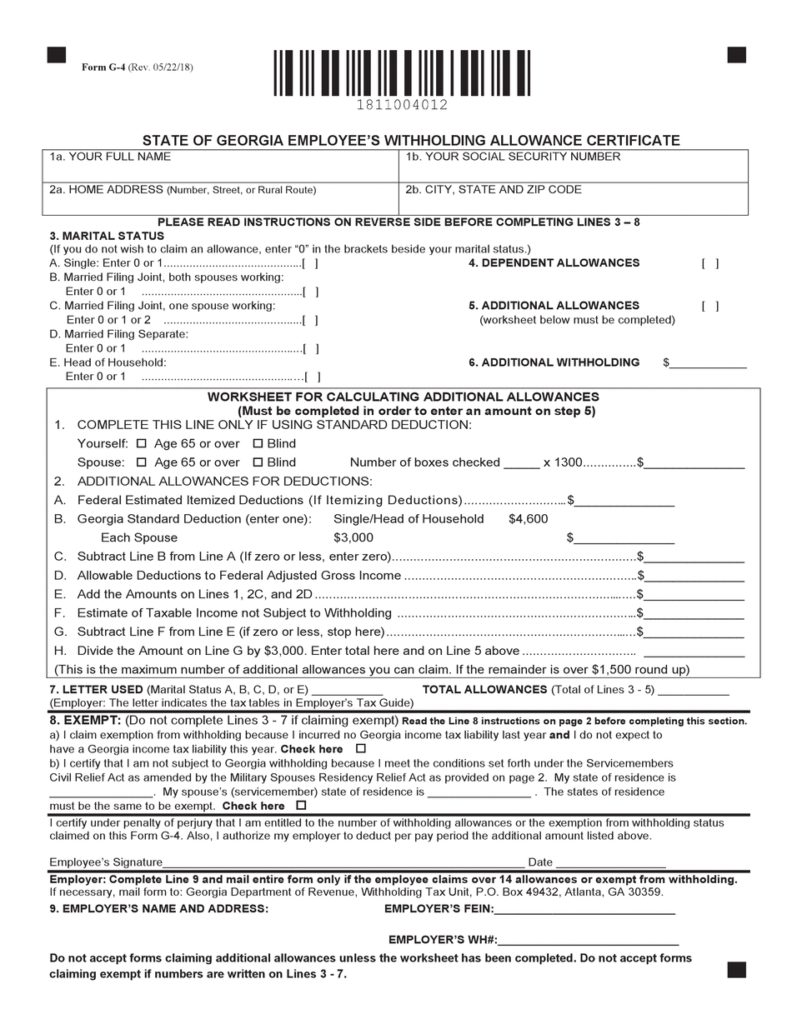

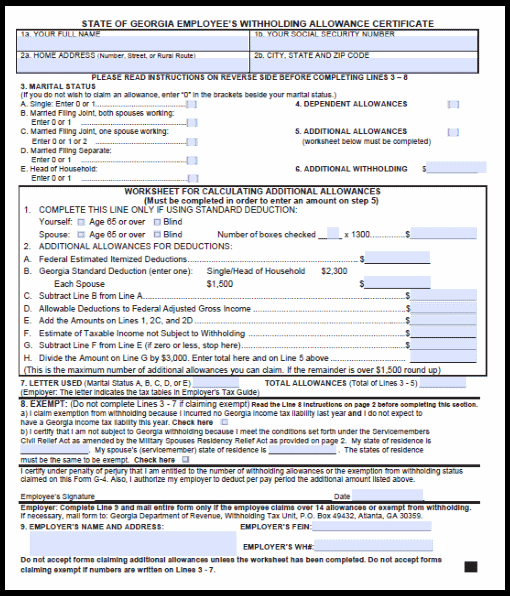

State Of Ga Employee Withholding Form 2022 – Before filing your annual state withholding tax form, you should be aware of a few things. The W-4, often known as the IL-W-4, can be a form that you need to very first discover ways to fill out. You can also use this form if you are a self-employed person. Typically, you can do this for free online. The form is accessible for down load about the IRS website. The form may then be ready swiftly by following the directions onto it. State Of Ga Employee Withholding Form 2022.

Kind W-4

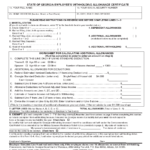

Annually, all staff are required to file their state Withholding Income tax Form with the Internal revenue service. Employees could establish out further resources for income tax purposes utilizing the kind. The repayment being withheld is stipulated from the mixed earnings of your and you spouse. Whether or not you’re married or not, it’s vital to give truthful information about your Kind W-4. The IRS provides a number of worksheets to assist you to figure out how significantly taxation you will be eligible to. As an alternative, you may determine how much money you can write off annually using the NerdWallet tax calculator.

You need to accurately comprehensive their state Withholding Certification in order to avoid overpaying taxation. Employers may use this particular type to establish how much tax should be subtracted from employees’ paychecks. An enormous equilibrium at income tax time, or a whole lot worse, simply being fined in excess of-withholding, could originate from improperly submitting the form. The newest W-4 Develop replaces worksheets with much easier inquiries although nonetheless using the same details as the older one. Employees ought to now be capable of determine their withholdings more precisely due to this adjustment.

You can complete the W-4 form without providing your SSN if you do not have any dependents. If your circumstances or your job change, you must update your information each year. If you change employment during the year in order to pay less tax, you might ask for a part-year approach of withholding. Although it’s crucial to complete the shape precisely, there might be instances when you need to change your withholding during the duration of the year. If you start a new employment in the middle of the year, ask for a part-year withholding mechanism.

You should mail the form to the state tax office once it has been completed. The W A HarrimanAlbany and Campus, New York City 12227-0865 is the place you could find the NYS Taxes Division. If you are unable to transmit the form via US mail, for more information, see to Publication 55. If you don’t get it within a year, you should mail it by certified correspondence.

Type IL-W-4

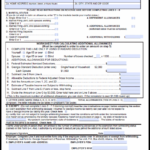

A significant file will be the Condition Withholding Allowance Certificate. It instructs your company how much state tax ought to be deducted through the earnings of your respective workers. The form is easy to complete and is also mandated legally. If you’re unsure of how to complete yours, Consult Publication 55. Each a test instructions and worksheet are provided. It is going to in the end help save you a ton of hassle and time.

Use the Part 5 withholding table if you’re married and your combined income is $107,650 or higher. Use this graphical by exchanging the less-paying out job’s earnings with the increased earner’s wages. You shouldn’t concern yourself with the income tax because this motion will decrease your taxation liability. The buck amount of the improved withholding should be computed twice. Compute your amount after which publish the shape.

If you’re an employer, you must submit a different form for employees. A officially required papers is definitely the Kind W-4. The form may be filled in and authorized by staff. To perform the shape, it really is advised to make use of the Form IL-W-4. You could possibly complete the shape with the aid of a free of charge manual. Also keep in mind that you are able to adjust the form’s withholding sum whenever you want in the past year.

Some jurisdictions more desire that staff complete condition withholding forms besides the national W-4. If you reside in one of these states, you must fill out and submit the state withholding form, in order for your employer to deduct the right amount of tax from your paycheck. The W-4 is a useful tool, but it needs to be filled out correctly. A new W-4 must be completed if you switch jobs.

If you reside in Illinois, you must submit the Form W-4. If you don’t have any dependents, you should still claim the appropriate number of allowances on your state’s form even. The calculator enables you to help with deciding just how much must be withheld. Your yearly tax responsibility could be calculated making use of the IRS website’s calculator. You are able to again use it to determine out what amount of cash you can set up for pension.