State Of Virginia Tax Withholding Form – You must initially be aware of the W-4 along with the information it requires before you can understand good reasons to complete a taxation withholding kind. Your workplace make use of the data you provide on the W-4 form to find out exactly how much taxes needs to be deducted through your income. This particular type is vital for making sure the internal revenue service appropriately accumulates federal government income tax. Although withholding too much could result in a return whenever you document your taxes, withholding the incorrect amount could result in penalties along with a income tax costs. State Of Virginia Tax Withholding Form.

Develop W-4

If your firm withholds taxes from your employees using Form W-4, you should review it each pay period to be sure the amount is accurate. You might have to pay more in federal taxes when you file your return if it’s wrong. Following a major daily life occasion, like a new task or relationship, you should reassess your withholding percentage. Your withholding quantity will even change based on the scale of your family members, the quantity of income you make annually, and any taxes credits.

The multiple task withholding cycle must be finished for hitched couples and individuals who function several jobs. It can determine the appropriate tax withholding figure to withhold from every one of your earnings. You could be entitled to the little one income tax credit rating or any other dependant taxes credit rating, for the way numerous tasks you have. Take advantage of the W-4 estimator provided by the internal revenue service or possibly a web site like NerdWallet’s taxes calculator to have an exact estimate.

the requirements for filling in a W-4

It is important to follow the IRS’s guidelines while filling in a W-4 tax withholding kind. In line with the form of revenue you will get, there are actually different methods to fill in this type properly. If you work two jobs and are paid a combined wage, you must fill out Sections A and B of the form, for instance. Normally, you must complete Steps 1 and two.

You have to file your W-4 once your employment reputation modifications or some other issue adjustments to actually satisfy every one of the standards. If insufficient money was withheld, you can end up owing a lot of money come April, it’s also crucial to keep in mind that the IRS expects people to pay their taxes all year long, so. Penalty charges and attention could result as a result.

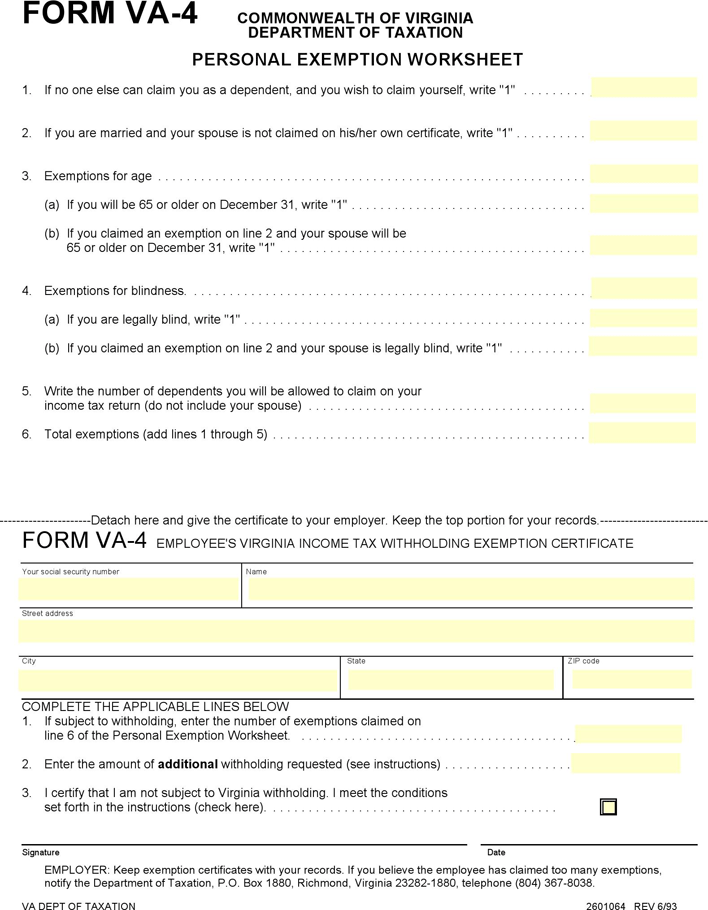

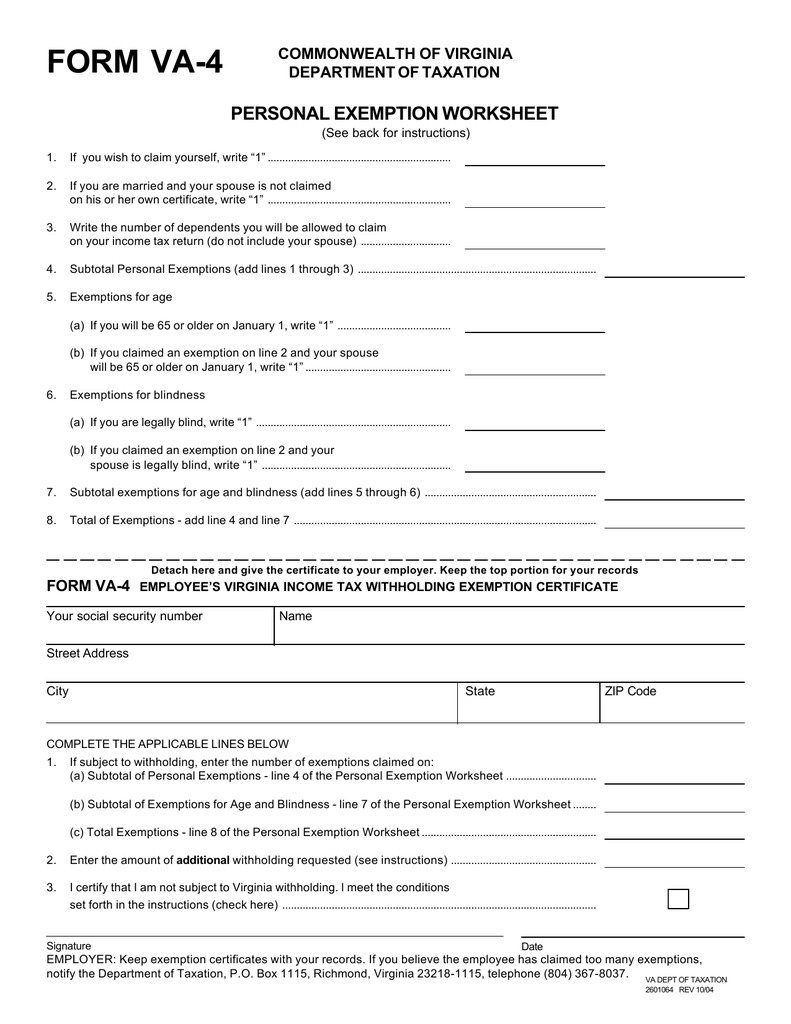

Exemptions from income tax withholding available

You can seek for a tax exemption if you work for a government organization. Government entities business will then make contact with you and give you the appropriate information, which include simply how much taxation will be subtracted out of your salary. Joblessness insurance coverage, sociable security, Medicare insurance, and supporting your children are typical exempt from taxation withholding. Each and every year, you have to publish clean kinds on the organization. You could even get in communication together with your workplace. Your circumstances might let you use multiple different.

If your state doesn’t take any taxes from your paycheck, you can petition for a federal income tax exemption. If you qualify for one of the exclusions, the government will issue you a refund check. If your income is below the IRS’s limits, you can request an exemption from tax withholding. However, you want to think about filing an exemption if your income exceeds the qualifying levels.

Calculator for withholding computations

The taxes return’s elaborate calculations really are a struggle for most people. You may make feeling of your stats and calculate the ideal withholding proportion to your circumstances with the help of a taxation withholding calculator. The findings of your calculator may not particularly complement precisely what is in your paycheck, while they may well give you a reasonable notion of your tax responsibilities. In this case, it’s vital to double-examine the calculator inputted statistics. You should get in touch with your employer and ask for a recalculation if they are different.

You can use possibly the portion or perhaps the accurate quantity of fees you are obligated to pay to discover the proper level of withholding. Regardless of whether you utilize a computerized or guidebook payroll process, it is advisable to make use of a calculator to find out tax withholding. The calculator will guide you throughout the procedure and acquire taxation credits into mind to calculate the complete quantity you have to withhold. You can owe more money at the end of the year than you anticipated if you don’t follow the guidelines. Within the second option case, you can be expected to pay out further taxes and curiosity.

Problems for low-American inhabitants

In order to declare taxable income for a non-citizen, the form must be served out and marked by the employee. Both employee’s Social Security variety and an productive ITIN are required. For the purpose of submitting federal government taxation, it is important to use these phone numbers to confirm an employee’s id. Some no-You.S. citizens might need to supply far more facts to ensure their position, dependant upon the kind of career.

A person Tax payer Recognition Number is required for no-people in order to be qualified for a Social Security number (TIN). This 9-digit variety is comparable to a societal stability variety. The TIN’s very first about three numbers must be among 88 and 70; the fourth digit must be involving 92 and 90. 94-99 ought to be the fifth and fourth digits.