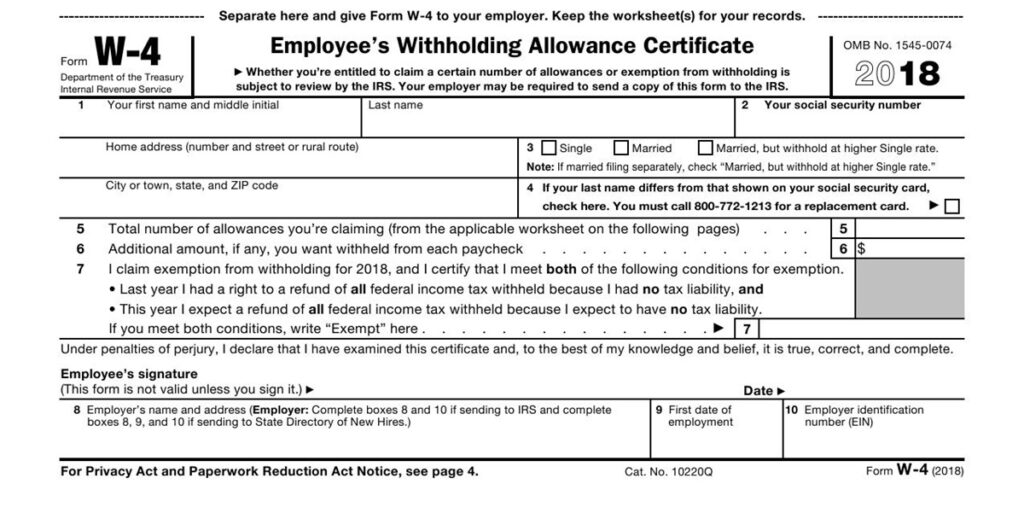

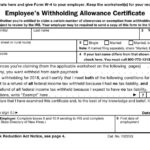

Washington Income Tax Withholding Form – Businesses employ Earnings Withholding Purchases, or IWOs, that are federal government kinds, to deduct income tax obligations from workers’ paychecks. IWOs could be personally or mechanically completed, and they also normally adhere to a develop offered by the IRS. The procedure is quite straightforward if you are aware of how IWOs operate. Here are some hints and pointers to assist you to finish your wages withholding develop. Washington Income Tax Withholding Form.

Requests for Revenue Withholding

A purchase known as a “Income Withholding Purchase” directs the employer to withhold a definite amount of cash from each employee’s paycheck. The Individual Safety Work mandates the use of an Income Withholding Buy. Generally, the deduction cannot be more than 50Percent of the Obligor’s non reusable revenue. If they choose not to withhold money from an employee, the employer could face sanctions.

An Ex Parte Revenue Withholding Order instructs a payor to take a certain amount of money from an obligor’s month-to-month cash flow. Typically, these orders are issued without providing the obligor with any prior notice of the order. Organisations are obligated to get started on subtracting repayments as soon as they are obtained as well as to deliver the money returning to the obligor inside several organization days of the spend day. A Department of Child Support Enforcement or Express Intravenous-D organization troubles money withholding buy (DCE). The employer must receive it even if it is typically not required to be signed.

IWOs

You certainly obtained Cash flow Withholding Forms should you get paychecks from the organization (IWOs). Once you get them, you may not know how to employ them or what to consider. The correct answer is within the Supporting Your Children Section of your Place of work of Attorney Common (OAG). It is possible to fill in an application on-line with the OAG Child Support Division’s web site. You should make sure to send the IWO to your new employer if you have one.

If an employee has over-the-limit withholding, make sure to include the amount in your withholding. The total amount to be withheld should at the minimum match this amount of money. Be sure to update the total amount for your pay cycle, as you might need to alter the Maximum Withholding %. To compute exactly how much you will need to pay, take advantage of the Withholding Limits Worksheet, which capabilities an internet based calculator.

electronic formats

Your business might be able to save your time by using auto revenue withholding varieties. For first time employees, classic types can be perplexing. The process is sped up using a wizard-like interface on automated kinds. They conduct calculations automatically and enforce common sense legal guidelines. As a result, there is no longer a chance of conflicting withholding decisions being made, and new recruits are less likely to make mistakes or forget to electronically sign their paperwork. HR also can help save effort and time by making use of automated types.

Organizations with many spots will benefit considerably from using an automated process. Every single area features its own distinctive income tax varieties, although some says tend not to implement money tax. You can make sure the right forms are supplied in accordance with local laws, by using a centralized online system. In order to make changes, no longer are several personnel need to be contacted. Workplace can then pay attention to far more crucial duties in this fashion. By removing the need to find forms, it also saves time and money.

Restrictions

Employers must declare the total amount they are deducting from employees’ paychecks on the restrictions on income withholding form and make up the difference within seven days, according to the law. Employers may be held liable for the whole amount of the withheld amounts if they don’t follow the rules. A $100 good can also be imposed on the company daily that the withheld sums will not be paid for. Employers can, nevertheless, avoid this responsibility by sticking with the CCPA rules.

Organisations have to abide by the earnings withholding constraints establish by the government. The Individual Credit Protection Take action, which manages payments to CSPC, determines the federal limits. The government has posted a message of view on lump-amount payments and mandates that businesses comply with the rules. However, many firms disregard these rules and wind up shelling out more money than necessary. Organisations have to follow the income withholding restrictions for that reason.

labeling the no-custodial father or mother

The employer will probably be knowledgeable how the noncustodial parent’s supporting your children responsibility arrives and must be paid by the revealing noncustodial parent on the earnings withhold type. Additionally, it can notify the noncustodial parent that their permit has become stopped. To get their certification reinstated, a noncustodial mother or father need to adhere to the child support payback program specific about this form.

Businesses are unable to answer queries from personnel regarding revenue withholding. The Non-Custodial Mother or father Notice, which is within the employer’s withholding packet, ought to be noted to employees instead. The policies for tough the income withholding purchase may also be specified about this type. The employer should direct them to the notice if an worker has any inquiries or concerns. It is vital to obtain this particular type on hand since it is also available on the State pay out model.